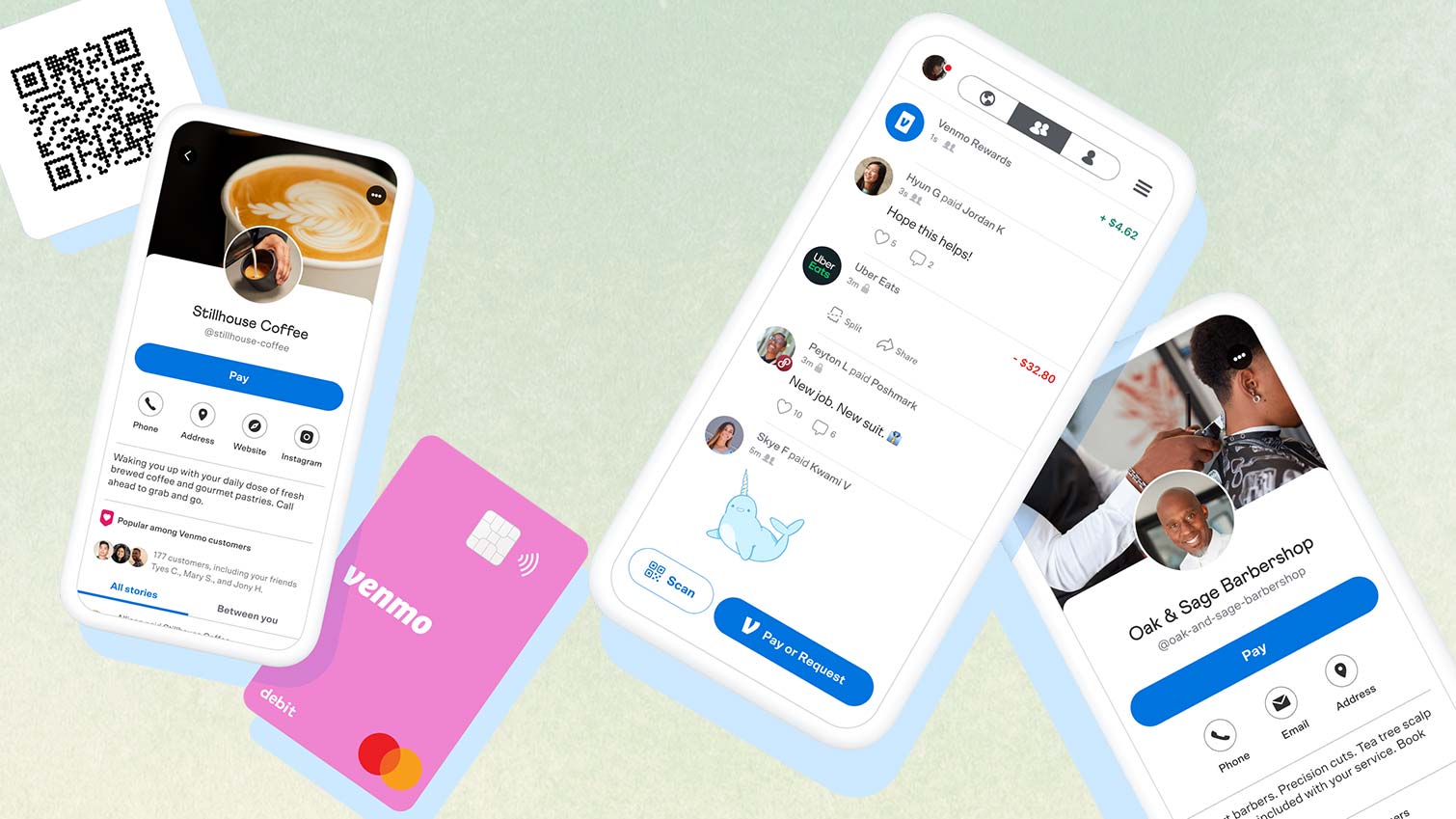

Venmo, the popular mobile payment app, has recently introduced a new feature: a savings account. This feature allows Venmo users to store their money in an interest-bearing account, which is accessible through the app. In this article, we will explore the benefits of a Venmo savings account and how to set it up.

The Venmo savings account offers several advantages over traditional savings accounts. First and foremost, it offers a competitive interest rate, currently at 0.10% APY (annual percentage yield). This rate is higher than the national average for savings accounts, which is currently around 0.05% APY. Additionally, the Venmo savings account has no minimum balance requirement and no monthly fees, making it more accessible to users with lower balances.

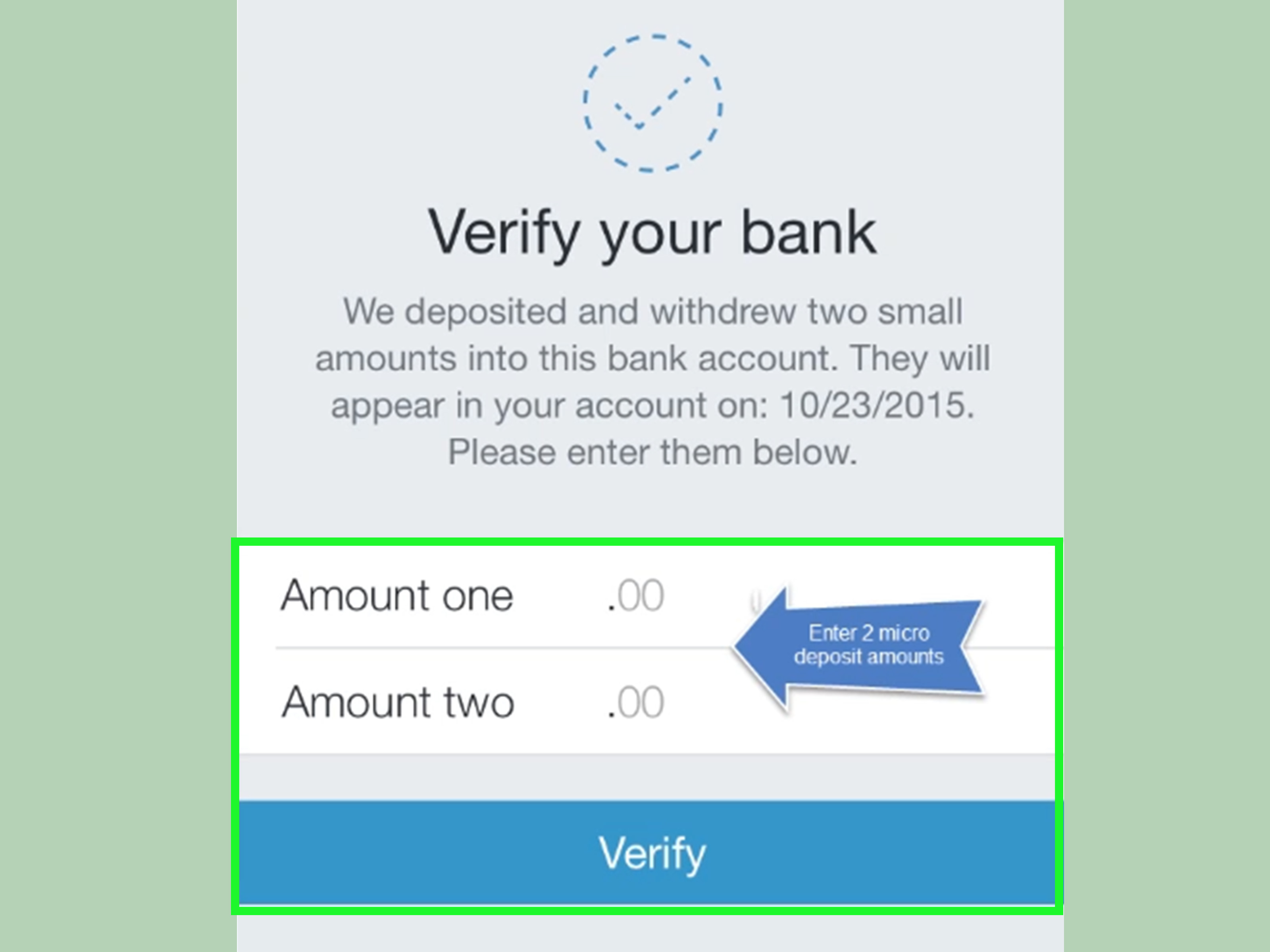

Setting up a Venmo savings account is a straightforward process. To begin, navigate to the “Me” tab in the app and select “Payment Methods.” From there, select “Add a bank or card…” and then select “Bank.” You will then have the option to choose your preferred verification method, which includes logging into your bank account or entering your bank account and routing numbers manually.

It is important to note that when linking your bank account to your Venmo savings account, you should link a checking account, not a savings account. This is because savings accounts traditionally have a limit of six online withdrawals or transfers per month, although some banks have lifted such restrictions after federal regulations changed in 2020.

Once your bank account is linked, you can begin transferring funds into your Venmo savings account. To do so, simply navigate to the “Transfer Money” tab in the app and select “Transfer to Bank.” From there, you can choose the amount you wish to transfer and select your Venmo savings account as the destination.

The Venmo savings account offers a competitive interest rate, no minimum balance requirement, and no monthly fees. Setting up the account is a straightforward process, but it is important to link a checking account rather than a savings account to avoid withdrawal limits. the Venmo savings account is a great option for users looking to earn interest on their savings while still having easy access to their funds through the app.

Adding a Savings Account to Venmo

Adding a savings account to Venmo is a straightforward process. Firstly, you need to open the Venmo mobile application and navigate to the “Me” tab by tapping your profile picture or initials. Once there, locate the “Settings” gear icon in the top right corner, and tap on it. From the available options, select “Payment Methods,” and then tap on “Add a bank or card…” Next, you need to choose the “Bank” option and select your preferred verification method. Venmo will ask you to provide your savings account details, such as bank name, account number, and routing number. Once you have entered the required information, Venmo will verify your account, and you will be able to use your savings account for transactions on the platform. It’s worth noting that adding a savings account may take a few days to complete, as Venmo needs to verify your account before you can use it. By following these simple steps, you can easily add your savings account to Venmo and enjoy the convenience of making transactions directly from your savings account.

What Type of Account is a Venmo Account?

Venmo is an online payment service that allows users to send and receive money electronically. When creating a Venmo account, users are required to link it to a checking account, not a savings account. This is because savings accounts typically have restrictions on the number of online withdrawals or transfers that can be made per month. By linking a checking account to Venmo, users can easily and quickly transfer money in and out of their accounts without running into any limitations or penalties. Therefore, it is important to ensure that the account linked to Venmo is a checking account rather than a savings account.

Conclusion

While Venmo offers the convenience of a savings account through its platform, it is important to consider the limitations and regulations that come with it. Users should note that only one savings account can be linked to their Venmo account, and it must be a checking account rather than a savings account due to federal regulations. Additionally, savings accounts typically have limits on the number of online withdrawals or transfers per month. Despite these limitations, Venmo’s savings account can be a useful tool for those looking to save money and earn interest on their funds. As with any financial decision, it is important to carefully consider all options and do thorough research before making a decision.